Hey guys, I am having trouble deciding between New York Life and Northwestern Mutual for life insurance coverage. What are the primary variations in the two organisation’s policies, customer support, and general level of satisfaction, for people who have dealt with one or both of them? Did any particular benefits or drawbacks catch your attention?

Any advice would be much appreciated as I make my choice!

2 Likes

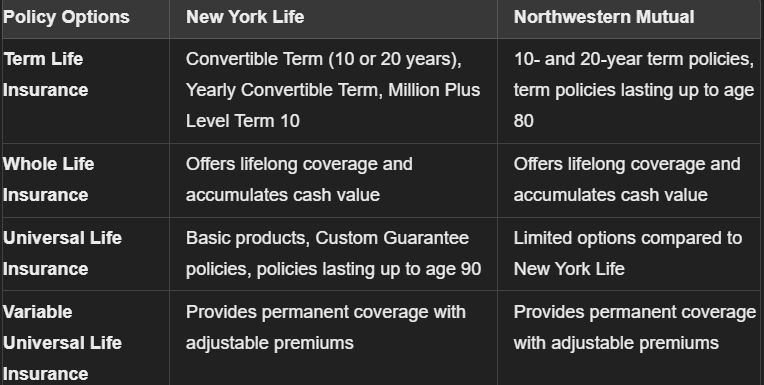

When comparing New York Life and Northwestern Mutual for life insurance coverage, consider policy options, customer support, satisfaction levels, and potential benefits and drawbacks:

Policy Options:

Customer Support and Satisfaction:

- Specific details on customer support and satisfaction are not provided. Check customer reviews and ratings from trusted sources or consult current policyholders for more insights.

Benefits and Drawbacks:

- New York Life: Broader range of riders, including the unique Spouse’s Paid-Up Insurance Purchase Option. Streamlined application process with TeleApp interviews. Lower BBB rating (B-).

- Northwestern Mutual: Online tool to match customers with financial professionals. Higher BBB rating (A-).

Financial Stability:

- Both companies have strong financial stability with A++ (Superior) ratings from A.M. Best.

New York Life may offer more flexible universal life insurance options and a broader rider selection, while Northwestern Mutual’s Custom Whole Life policies could be beneficial for cash accumulation.

1 Like

New York Life offers a wide range of policies and has great customer support with user-friendly online services. On the other hand, Northwestern Mutual is known for personalized financial planning and strong dividends. I found New York Life’s technology easier to use, but I appreciated the personalized attention from Northwestern Mutual’s agents. Both companies are solid, so it really depends on whether you value technology and flexibility (New York Life) or personalized service and dividends (Northwestern Mutual).

1 Like

Northwestern Mutual are the business version of pump and dump. They promise you the world during onboarding and glorify the entrepreneur/owner of your professional spirit before forcing you to cram insurance down your loved one’s cram holes till they loathe you and you’re dying within. Aside from that, there is nothing particularly wrong with them.

Hi Terryanne!

I hear you, it’s tough when a company sells you a dream that turns out to be a nightmare.

I had a similar experience at another insurance company. They paint this picture of freedom and financial success, but in reality, it’s all about meeting their sales targets no matter the cost to your personal relationships or mental health.